Chariot Limited, a London Stock Exchange-listed independent transitional energy company, has been making waves in the energy sector. As investors and traders alike keep a close eye on its progress, understanding the dynamics of the Chariot share price becomes crucial. This article delves into the key factors influencing Chariot’s stock performance, providing insights into its recent trends, and offering a glimpse into potential future prospects.

Understanding Chariot Limited

Chariot is a company focused on developing transitional energy projects, primarily in Africa. Its portfolio includes offshore gas discoveries, renewable energy ventures, and green hydrogen initiatives. The company aims to play a significant role in the global energy transition by providing cleaner and more sustainable energy solutions.

Key Factors Influencing Chariot Share Price

Several factors can significantly impact the fluctuations of Chariot’s share price:

Project Progress and Developments:

Exploration and Appraisal: Successful exploration and appraisal activities, leading to the discovery of commercially viable gas reserves, can boost investor confidence and drive the share price upwards. Conversely, setbacks or delays in these activities may negatively impact investor sentiment.

Project Sanctioning and Development: The final investment decision (FID) for major projects, such as the development of offshore gas fields or renewable energy plants, is a crucial milestone. Positive FIDs can trigger a surge in share price, while delays or cancellations can lead to significant declines.

Production and Sales: The commencement of commercial production and the successful sale of energy products are key drivers of revenue and profitability. Strong operational performance and consistent cash flow can positively influence investor perception and support a higher share price.

Commodity Prices:

Oil and Gas Prices: As Chariot’s core business involves natural gas exploration and production, fluctuations in global oil and gas prices can have a direct impact on its revenue and profitability. Rising commodity prices can enhance the company’s financial prospects, potentially leading to a higher share price. However, declining prices can negatively affect its earnings and investor sentiment.

Renewable Energy Prices: The price of renewable energy sources, such as wind and solar power, can also influence Chariot’s share price, especially as the company expands its renewable energy portfolio. Competitive renewable energy prices can make Chariot’s projects more attractive, potentially boosting investor confidence.

Regulatory Environment:

Government Policies: Changes in government policies related to energy exploration, production, and renewable energy development can significantly impact Chariot’s operations and financial performance. Favorable regulatory frameworks, such as supportive tax incentives or streamlined permitting processes, can create a conducive environment for the company’s projects, potentially driving the share price higher. Conversely, stricter regulations or unfavorable policy changes can increase costs and hinder project development, negatively impacting investor sentiment.

Environmental Regulations: Increasingly stringent environmental regulations can impact the cost and feasibility of energy projects. Chariot’s ability to comply with these regulations while maintaining project viability is crucial for its long-term success and can influence investor perception.

Industry Trends and Competition:

Energy Transition: The global energy transition towards cleaner and more sustainable energy sources presents both opportunities and challenges for Chariot. The company’s ability to adapt to this evolving landscape and capitalize on emerging technologies will be critical for its future growth and can significantly influence its share price.

Competition: Chariot operates in a competitive energy landscape, facing competition from both established players and new entrants. The company’s ability to differentiate itself through innovative technologies, competitive pricing, and strong project execution will be crucial for its success and can impact its share price.

FAQs

What is the current share price of Chariot Limited?

The latest share price of Chariot Limited (CHAR), a company listed on the London Stock Exchange, was approximately 1.936p, with a daily fluctuation observed between 1.748p and 1.936p as of December 12, 2024. Prices are subject to change during trading hours and are usually delayed by at least 15 minutes. Always refer to trusted financial platforms like Hargreaves Lansdown for real-time updates.

What factors influence Chariot’s share price?

Chariot’s share price is influenced by several factors, including:

Operational Updates: Progress on its Anchois Gas Project in Morocco and partnerships like its collaboration with Etana, which secured a $100 million guarantee finance deal.

Energy Market Trends: Global oil and gas prices directly impact investor confidence in energy companies.

Market Sentiment: News on company leadership, such as recent executive changes, and industry developments also play a role.

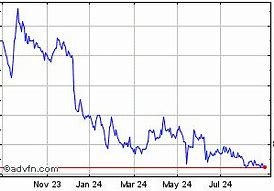

What is the historical performance of Chariot’s stock?

In early December 2024, the stock ranged between 1.72p and 2.53p, reflecting high trading volumes. Over the year, the share price has been volatile, influenced by operational milestones and market conditions.

Does Chariot Limited pay dividends?

Currently, Chariot does not distribute dividends. As an exploration and production company focused on growth projects, it reinvests earnings to fund operations like the Anchois development.

Is Chariot Limited a good investment?

Chariot’s investment potential depends on your risk tolerance:

Positive Outlook: Its strategic focus on renewable energy and partnerships like Total Eren suggest long-term growth potential.

Risks: The company operates in a volatile sector with significant dependency on project success and global energy trends.

What is the market capitalization of Chariot Limited?

As of December 2024, Chariot’s market capitalization was approximately £24.42 million, reflecting its position as a small-cap energy company.

Where can I buy Chariot shares?

Chariot shares can be purchased through trading platforms that offer access to the London Stock Exchange, such as Hargreaves Lansdown or AJ Bell. They can be held in accounts like Stocks and Shares ISAs, SIPPs, or general investment accounts.

What is the future outlook for Chariot Limited?

Chariot’s future relies heavily on its ability to deliver results in key projects like Anchois. Additionally, its diversification into renewable energy through partnerships is promising, aligning with global decarbonization trends. However, the company must manage financing and operational risks effectively to ensure sustainable growth.

To conclude

Chariot Limited operates in a high-risk, high-reward sector, making its share price an area of active interest for investors. The company’s focus on the Anchois Gas Project and renewable energy partnerships underpins its growth strategy. However, the share price is sensitive to operational progress, energy market volatility, and broader economic conditions.

Investors should monitor updates on Chariot’s projects, leadership changes, and financial strategies to make informed decisions. Recent developments, such as the $100 million financing for its projects, indicate progress in addressing capital requirements. For potential investors, Chariot represents an opportunity to capitalize on the transition to renewable energy and natural gas but requires a willingness to navigate significant volatility.

To read more , click here